Thinking about the linkages between US and European tech investment and startup scenes ahead of the Slush conference in 10 days, I found an interesting paper: Deal or No Deal: The Growth of International Venture Capital Investment (PDF here) by Pandya and Leblang of University of Virginia.

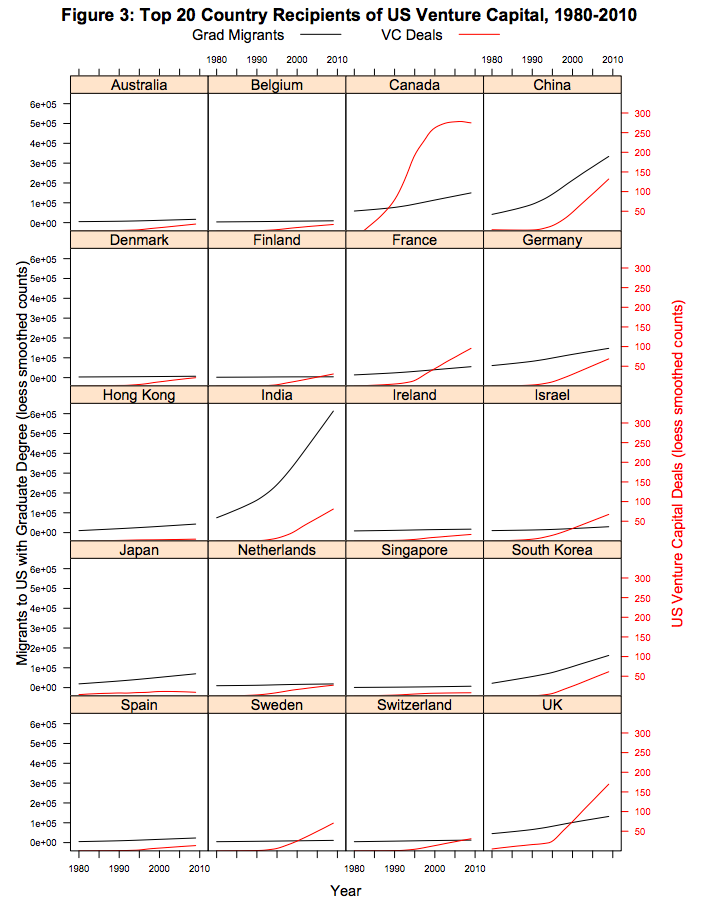

Recommended reading in full for anyone who cares about intercontinental talent and capital flows, but I just wanted to share this fascinating graph:

You can often hear how foreign investments and emigration are discussed as linearly opposite ends of a see-saw: if you get more of cash invested into your country from abroad your skilled talent can stay home and build companies there as opposed to seeking interesting challenges abroad. What the authors show here is rather a two-way street, another re-inforcing cycle where the movement of talented people will eventually build into increased cross-border investment of capital:

We find that US VC firms invest more frequently in countries that have large populations of skilled migrants residing in the US. In stark contrast to existing FDI research, we find that recipient countries political institutions have limited influence over the volume of venture capital deals.