Stanford GSB Sloan Study Notes, Week 7, Summer quarter

Pages assigned for reading: only 108!

With the Negotiations crash course ending, due date and presentations of the group projects in Strategy Beyond Markets and all kinds of housekeeping for study groups and Winter/Spring quarter high demand class application “superrounds” and now a long Labour Day weekend ahead, this week turned out to be quite a gear shift down… But a few notes to take down still.

POLECON239 – Strategy Beyond Markets (prof Jha)

- “You can always trust the USA to do the right thing, once they have exhausted all other alternatives” – Churchill

- The public pressure on AIDS drugs pricing in Sub-Saharan Africa made US government to _stop pressuring_developing countries on pharma IP issues in 90s

- Did not officially change their view on TRIPS and other international agreements – those still in force

- Yet “closed” an eye so that Brazil, Thailand, South Africa, India could start producing cheap copies

- US own GlaxoSmithkline put into substantially worse competitive situation

- Class-triggered open question to self: what happens to the pharma IP dynamic in the context of medical singularity (e.g when less than a year of treatment can add more than a year to a human’s lifespan)?

- typical conflict cases (pricing, access to drugs in developing world) to date seem to focus on medication that is intended to reduce suffering, fix diseases, delay death through sickness

- how will the global relations and corporate VS public needs play out when the drugs are not about fixing diseases, but enhancing/prolonging healthy life?

- Allegedly some data shows PE/VC investments into life sciences with a negative return over last 20 years?!

* Herbert – can you find a link to go deeper on this? whose data?

- Decomposition of complex issues is a natural problem solving heuristic for humans

- Integration of those pieces later is not

- Very important for managing the complexity of non-market interactions

- Any non-market interaction can…

- mitigate effects (example: what happens when Iran stops selling oil?)

- magnify effects (example: actors respond to each others’ behaviour by becoming more involved. accentuates the challenge)

- Market & non-market competition:

- Similarities: you can think of political action in supply and demand terms (politicians vs electorate)

- Differences:

- Voluntary exchange (market) versus coercive (institutions) power

- Coin of the realm: $$ (market) versus sources of access, rights, influence (non access)

- Decomposition of complex issues is a natural problem solving heuristic for humans

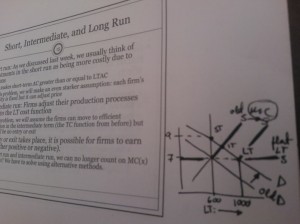

MGTECON209 – Statistics & Economics (prof Oyer)

- In simplest competition models supply slopes up because higher prices induce increase in current suppliers production or entry of new identical firms

- In perfectly competitive markets

- fixed costs tend to be more avoidable(sounds like a paradox)

- reason: if the market entry is really easy, it is more likely you can sell your entire business as a single item (ex: dry cleaners or news stand)

- price can be deducted from knowing only the cost (no information of demand needed)

- fixed costs tend to be more avoidable(sounds like a paradox)

- Long-term economic (not accounting) profit of competitive markets is zero

- economic costs include all opportunity costs (value of leisure, ROI of benchmark competition – like 20% return of capital, any other alternative uses of the same capital)

- meanwhile, accounting profit is higher than zero because all these costs are hard to adequately account for

- zero economic profit means the firm is indifferent to being in this business or exiting

- After shocks, markets return to equilibrium through: entry/exit of firms & increase in incumbent production levels

- Economics meets philosophy – analysing equilibria and market outcomes, consider two dimensions

- Efficiency – how large are total benefits for society?

- measured through surplus (ideally) or GDP/profits (practically)

- optimised for by libertarians (extreme), republicans, conservatives

- Equity – how fairly are these benefits divided?

- measured by metrics such as “what fraction of wealth held by top X%”, “difference in wealth by top and bottom quartiles”

- optimised for by communists (extreme), democrats

- Efficiency – how large are total benefits for society?

- Supply curve is a flat horizontal line for long-term, perfect markets with free entry

- In that situation, producer surplus is zero

- We wish markets as a whole operated as a firm (marginal revenue = marginal cost), but that of course never happens

- Global trade increases _global_welfare

- Locally measured welfare might not: e.g blue-collar jobs shifting from US to China much faster than high value add ones -> unemployment numbers differ in segments -> income gap grows

- Main reasons for market inefficiencies

- Market power (infrastructure-based monopolies)

- Externalities not captured by the price system

- for example: larger share of poor has indirect societal cost through crime

- Information limits

- Great experiment of mobile coverage expanding on coast of India. The fisherman had to choose which village they try to sell their daily catch based on very low information (guessing/hoping where demand would be). With mobiles, the actual sales price corridor narrowed from 2..16 to 7..9 rupees per unit & the amount of fish unsold and thrown away by the evening dropped to zero.

- Ecomics is about maximising** **the pie, market strategy about capturing a slice of the pie

- We tolerate market inefficiencies because market power (like granted IP protection for a time period) makes innovation worthwhile

- Most interventions in competitive markets (taxes, subsidies) lower total surplus (consumer + producer)

- hurt consumers and/or cost governments more than they help producers

- yet, they provide infrastructure to make markets more efficient or break monopolies / limit market power

Managing Difficult Conversations session (actually a waste of half a day, but trying to extract something positive nevertheless..)

- Thomas Killman Conflict Mode Instrument

- One thought combining TKI & the Negotiations learnings: if you imagine a conflict of interest in a situation involving people of different power, like a customer & a super market clerk

- there is a possible reaction of strong competition/conflict triggered because of the clear difference in power (TKI scale: High Assertiveness, focus on your interests) makes “winning” likely (spend an hour to escalate to clerk’s manager, argue, fight…)

- …whereas there is virtually zero value in the future relationship (TKI: Cooperativeness, focus on relationships) and thus the rational choice could be avoid/ignore conflict (do something else with the hour that actually benefits you)

- One thought combining TKI & the Negotiations learnings: if you imagine a conflict of interest in a situation involving people of different power, like a customer & a super market clerk

- Suggested quick end-of-project peer to peer feedback format between all team members: “Because of you, I

”

For more posts on the Stanford GSB Sloan life – click here to search by tag “sloan”.