Stanford GSB Sloan Study Notes, Week 5 (25), Winter quarter

This midterm week was quite light for classwork – as my elective set happened to have no actual midterm exams.

There was some time to think about an own group project (a business plan for a language teaching/feedback service that plugs into your daily communications flow in foreign language), help out a group of MS&E students writing a project on Skype and another group researching management approaches for their Paths to Power class, reminiscence of the good old days with Howard (the first investor in Skype), drop by the very maltheesque-looking Rdio offices, have calls with two new startups with impressively useful mobile apps in development, visit a stealth mode space startup about to launch some beautiful tech off this planet and then celebrate the Chinese New Year and Gustav’s birthday. And finally play a full round of golf at the Stanford Course.

Wow, actually sounds like a busy week now. The good busy.

Relative short study notes covered in this issue:

- Optimal portfolios and cost of capital

- More VC term nuances, especially around founder control

- Guests: founders on SunRun & Intuit, VCs from Accel & Foundation Capital. And Christy Turlington.

FINANCE 229: Sloan: Core Finance (Strebulaev)

- Fatal flaw in decision making: once one differentiating parameter is found between too choices, you stop investigating other parameters and make the choice. Empirically shown as a common issue with angel investors.

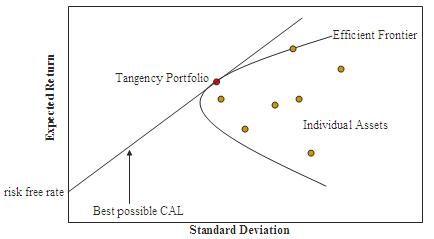

- Optimal portfolio is the tangent point between the efficient frontier and SML (security market line). Below that you can diversify with risk-free instruments (50% in TBills + 50% split between stocks per optimally chosen stocks), above that you can borrow money at risk-free rate and increase the portfolio to earn more (at linearly higher risk).

- For portfolio optimisation the correlation matters more than relative expected returns. Ex: gold has low expected return, but it tends to pay out exactly at times other asset classes don’t.

- Beta takes into account both volatility and correlation

- All portfolios for passive investment should converge on optimal distribution. In reality, the disagreements on covariance and active investing (disagreeing with markets) don’t let it happen.

- Volatility of a large portfolio: not necessary to find the correlation pairs for every component to every other, but to compare any given stock to the rest of portfolio. Adding a security will only improve your portfolio if its reward/risk ratio exceeds that of your exiting portfolio. (Sharpe ratio)

Cost of Capital

- Market to book value can be very high when there is fast expected growth, OR the assets in book value are very old (US Tobacco, established in late 18th century – no growth, but market/book >100)

- Underestimating the cost of capital you will undertake projects that can be actually unprofitable (as far as real NPV goes). And overestimating CoC you will pass on potentially profitable projects. Just “being conservative” can be very expensive.

- Picking the risk-free rate needs consistency. Don’t mix (average) different time periods, past real numbers with future expectations, etc.

- For an investment project’s risk-free rate choose the forward-looking (not historic) current treasury rate that is similar in length to your project duration. In case of public stocks, the “average” investors holding horizon of stocks shouldn’t influence which market rate you choose (if one investor sells stock, someone else will own it)

- FTSE100 is the S&P500 analogue in principle, but wouldn’t use it for asset beta calculations: because the distribution of huge vs small companies is much different in UK, it would give you misleading comparison base.

- Five-year rule of time for asset beta datasets is a compromise between preciseness and having enough data points. The longer the better if the risk profile is the same, but companies and markets change. Monthly data is another compromise: weekly & daily data introduce more noise – but you might want to use it if your total period goes well below 5 years.

- Notion of “industry” is misleading around beta: research shows that variance of beta inside industries is larger than between industries.

FINANCE 373: Entrepreneurial Finance (Korteweg)

- Can be misleading to think of pre-money valuation as “the worth of the founders” or their “idea and work this far”, for a few reasons

- the option pool allocated dilutes the founders

- post-round the founders shares typically still vest for years

- Non-cumulative dividends just disappear if not paid in a given year, cumulative dividends stack up to be paid whenever there is an exit (at any next year). Thus the latter is very similar to participating feature of preferred stock, and has recently been often used as a replacement for participation demands.

- About 30-40% of all rounds in last few years have some participating element and close to 60% have no cap. 97% have weighted average anti-dilution, 2% none and the few remaining full ratchet. (Fenwick & West VC Survey 2012 Q3)

- Weighted anti-dilution shortcut formula:

- New Conversion Price = ((Pre-Money valuation = Old Conversion Price * # of old Shares) + New Money) / (# of Old Shares + # New Shares)

- # New Shares comes from Excel goal seek on the cap table, where the intended Equity share % for new investor at their New Money injected is given

- Approach term sheet analysis systematically, bucketing particular small points into themes: valuation, liquidation, anti-dilution, governance & control, employment & vesting

- Green/yellow/red flag lists from the class slides

FINANCE 385: Angel & VC Investments (Strebulaev)

Featuring Theresia Gouw (Accel)

- Special voting rights: it is in everyone’s interest to get them uniformly applied to all preferred stockholders, not based on round. For example, 95%+ term sheets have investor rights to vote on mergers/sales – gets very complex to manage if B-round investors have preceding right to earlier ones, etc. Special rights for approving new financing are used slightly less, in ~80% cases.

- In 80% of cases founders have voting rights control (vs balanced board / investors) before 1st VC round, and just 20% of cases after 1st round, down to 10% after 2nd round. After 1st round the dominant model is balanced (~50% cases) and after second round investors (50%+). Investors control 70%+ of companies with any more rounds. (Dow Jones Venture Capital Deal Terms Report 2009)

- Empirical studies show notable increase in outcome success for companies with founder still in senior operating role. No data for similar conclusions on founder board control.

- Up to a quarter of US companies have Class A & Class B separation of capital and voting rights. Was very uncommon before Google did it. Investment bankers hate it – several large mutual funds still don’t buy into IPOs with class separation. Ford is a rare “old” example: Ford family owns ~3% of the company but ~40% of voting rights.

- Drag-along rights end up being used mainly in cases where there were several founders who now can’t agree, rarely by investors to force active founder(s) into a deal they are opposing.

- Non-competes are are virtually unenforceable in California, and differ by other states / internationally.

- Creative vesting schemes (ex: IRR-based vesting in growth stage) are practically not used because execution and taxation complications. Milestone-based cliffs are a potential alternative.

- Up until 6-7 years, the idea of any secondary stock sale by founders was very extraordinary: for example, investors buying 5% of founders holding in order to make it easier for them to turn down a $100M offer on the table and wait some more time for $500M exit. Investors among themselves discussing a practical custom arrangement (“do you need $1M in cash today? $3M? $10M?”), rather than planning ahead for this in term sheets.

- Some movement (Founders Fund?) in last 5 years, advocating founders always selling in B-C rounds, strong old-school opposition.

- Additional potentially negative issue with open second market sales rights: the overhead of managing random investors walking in.

- Trends underlying average vesting times getting shorter: cycle times to product launch have gotten shorter, yet cycle times to liquidity much longer.

- Complications with double-trigger founder vesting: you make them re-vest in what? acquirer’s stock (much less upside)? what if it was a cash transaction?

Case: SunRun: Raising the Series A Round

Guests: Edward Fenster & Lynn Jurich, (Co-CEOs, SunRun), Steve Vassallo (Foundation Capital)

- Simple term sheet becomes basically a character issue: either they will be great and easy to work with or… Reference checks are the only way to decide.

- East coast mindset is different: term sheet close rates are maybe 85%. Sometimes people 6 months out of college can send you a sheet – most everything is still negotiable.

- Can send first term sheet with X, Y & Z as placeholders for numbers. This way the founders can see the framework, but you can be in meeting or on call to make numbers more of a dialogue, noone freaking out alone.

- Redemption rights are offensive to entrepreneur. This basically turns the investment in to debt.

- A strategy on VC side: anchor on a percentage share (say 30%) of post-money valuation and let everything else (angel dilutions, etc) derive from that.

- VCs in the Valley talk a lot – when you start telegraphing a round size that doesn’t sound like one VC firm can take it alone, they will start grouping up and this could hurt your valuation. If you start with $3-5, you can get one firm going and then it is for them to calculate if that takes you actually far enough or should the first round be larger already.

- Business model innovations can be very interesting, but watch out that there is accidentally no financial arbitrage in the model that would eventually get squeezed out when business grows / others enter.

- When everybody else wants to own a ADSL equipment company, maybe you want to own the cable [service] company?

- During the tough time your physical energy as a founder is so key to get stuff done and motivate others that you need to take the time sleep and exercise.

- Multi-founder teams need to learn to stop looking over each-other’s shoulders. Having two sit in the same product meetings all the time is a waste of time.

- Went from CEO+President structure to Co-CEOs. One facing towards 250 employees, the “CEO of operating company”. The other, when raising billions of dollars, also needs to be perceived as CEO by external partners.

STRAMGT 354: Entrepreneurship & Venture Capital (Wendell)

Unfortunately can not publish my notes from (fantastic) class discussions – there is a no-blogging policy to protect honest conversations and especially the guests.

Case: original 1984 business plan of Intuit. Would you invest and on what terms?

Guests: Scott Cook (founder, Intuit), Eric Schmidt. I am just weeping that I can’t publish my notes of these two gentlemen discussing culture and scaling…

MKTG 249 : Re-Imaging Marketing: The Power of Stories (Aaker)

Guest: Christy Turlington Burns (Every Mother Counts)

—-

For more posts on the Stanford GSB Sloan life – see the table of contents here.